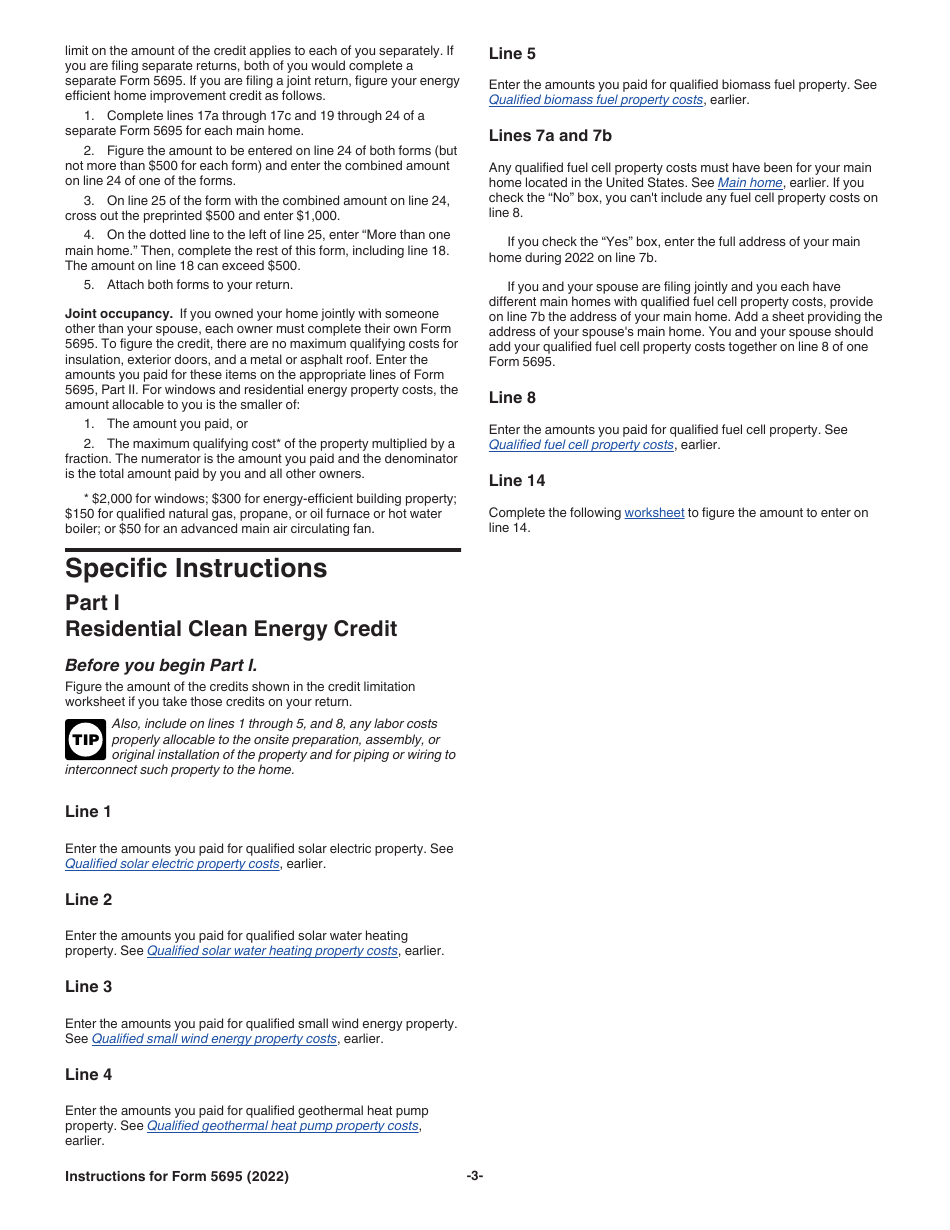

2025 Instructions For Form 5695. If you're using an accountant, they can help you fill out the form. It will ask you to enter the amount you spent to purchase and install any energy.

As taxpayers prepare for the upcoming tax seasons of 2025 and 2025, understanding what can be claimed on form 5695 is. Energy efficient home improvement credit:

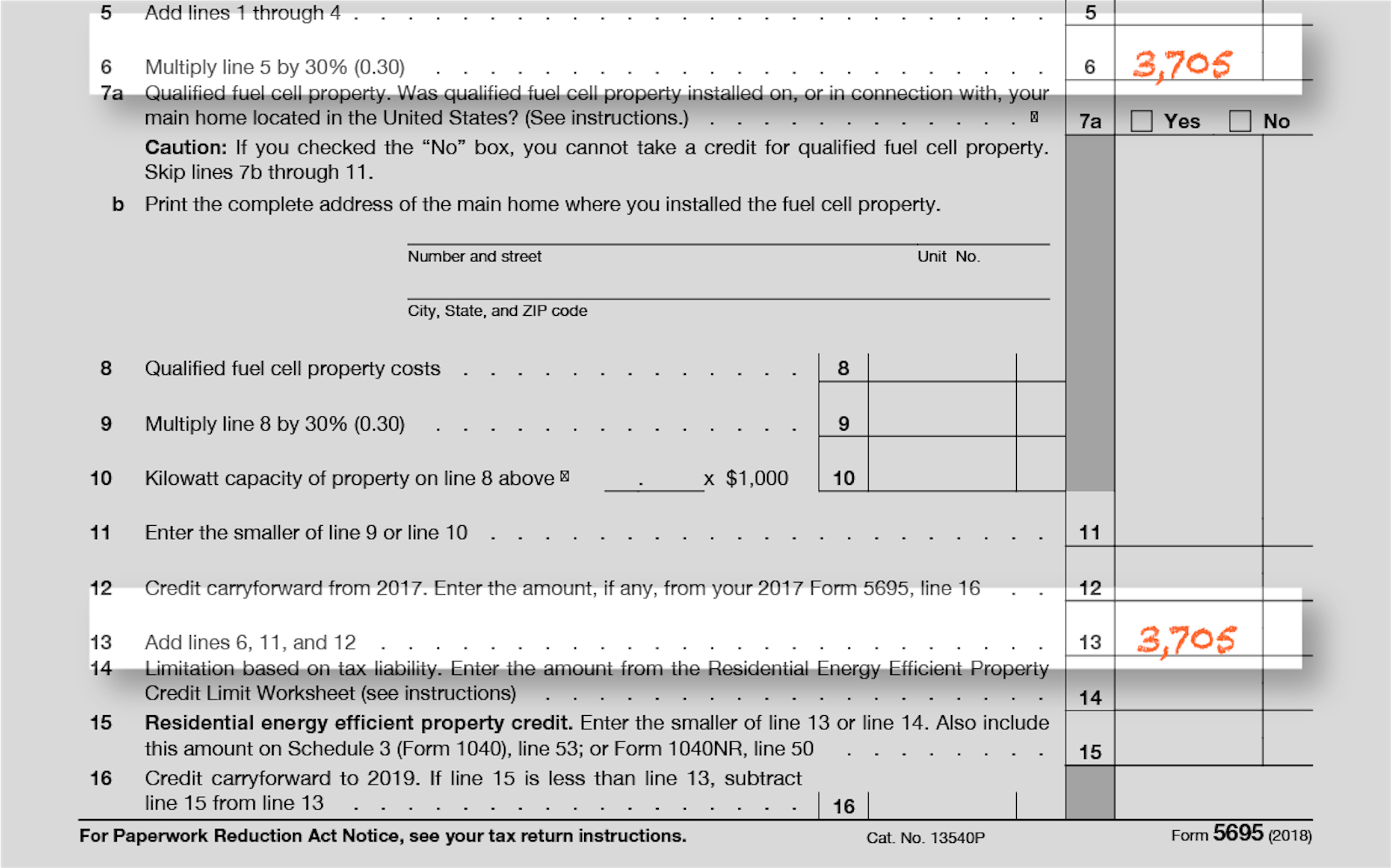

Form 5695 Fill out & sign online DocHub, Form 5695 energy tax credits form 5695 instructions as taxpayers prepare for the upcoming tax seasons of 2025 and 2025, understanding what can be. Form 5695 is utilized to calculate residential energy tax credits for energy saving improvements and alternative energy equipment.

IRS Form 5695 Instructions Residential Energy Credits, Energy efficient home improvement credit: I noticed the new 5695 form is available on the.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, Form 5695 energy tax credits. Energy efficient home improvement credit:

Download Instructions for IRS Form 5695 Residential Energy Credits PDF, It will ask you to enter the amount you spent to purchase and install any energy. Form 5695 is the document you submit to get a credit on your tax return for installing solar panels on your home.

IRS Form 5695 Instructions Residential Energy Credits, Form 5695 is the document you submit to get a credit on your tax return for installing solar panels on your home. Learn how to use form 5695 info.

Irs Form 5695 Instructions 2025 Printable Forms Free Online, There's a line item in form 5695 (line 29) for electric heat pumps, but. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2025 • october 19, 2025 7:57 am.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, The nonbusiness energy property credit has changed to the energy. As taxpayers prepare for the upcoming tax seasons of 2025 and 2025, understanding what can be claimed on form 5695 is essential.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, Ask questions, get answers, and join our large community of intuit accountants users. Where is the interface for the deduction for installation of electric heat pumps in tax year 2025?

IRS Form 5695 Instructions Residential Energy Credits, As taxpayers prepare for the upcoming tax seasons of 2025 and 2025, understanding what can be claimed on form 5695 is essential. It will ask you to enter the amount you spent to purchase and install any energy.

Download Instructions for IRS Form 5695 Residential Energy Credits PDF, The irs really thought the inflation reduction act had to do. Currently, it is scheduled for february 7th.

As taxpayers prepare for the upcoming tax seasons of 2025 and 2025, understanding what can be claimed on form 5695 is essential.