How Much Is Mileage Reimbursement 2025. * airplane nautical miles (nms) should be converted into statute miles (sms) or. 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own.

65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own. 2025 irs mileage reimbursement rates beginning january 1, 2025, standard mileage rates for the use of a car, van, pickups or panel trucks will be:

5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys.

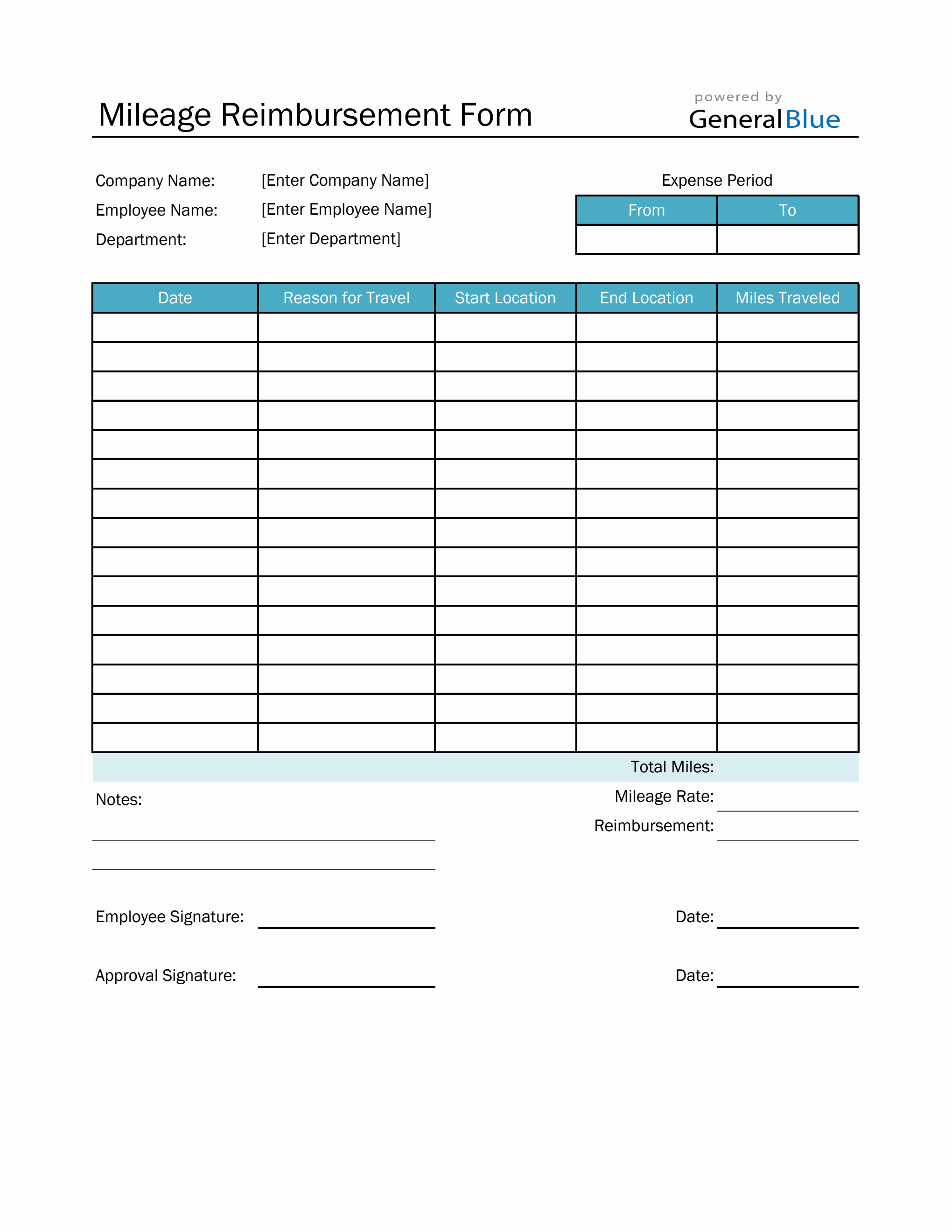

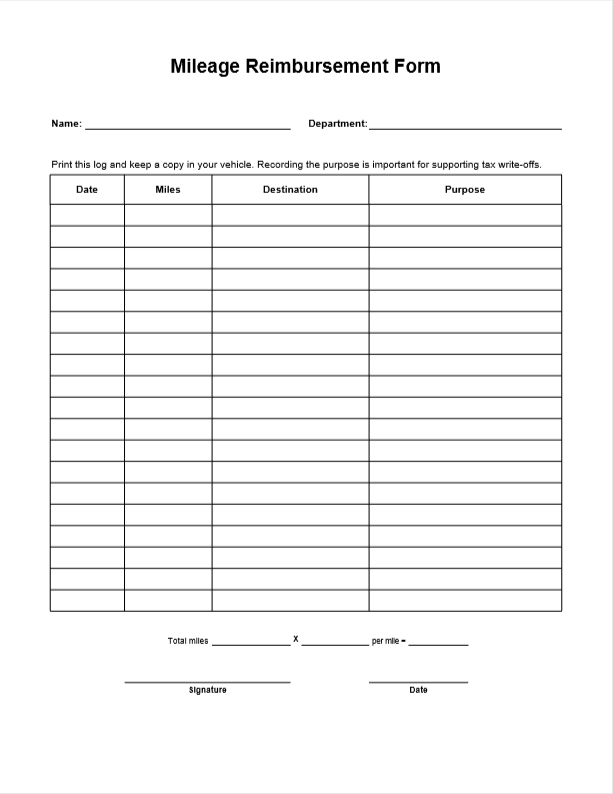

Mileage Reimbursement 2025 Form Noemi Angeline, My company is currently doing a review on the reimbursement rates for car and motorcycle that employees use to travel for business purpose, eg. Rates are reviewed on a quarterly basis.

Tax Rate For Mileage 2025 Edin Nettle, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2025.

Mileage Reimbursement 2025 Uk Calculator Meggy Silvana, 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own. Rates are reviewed on a quarterly basis.

How Much Is Mileage Reimbursement For 2025 Deny, Passenger payments — cars and vans. * airplane nautical miles (nms) should be converted into statute miles (sms) or.

Department Of Labor Mileage Reimbursement 2025 Elena Heather, My company is currently doing a review on the reimbursement rates for car and motorcycle that employees use to travel for business purpose, eg. Passenger payments — cars and vans.

Typical Mileage Reimbursement 2025 channa chelsey, What is the current mileage reimbursement rate for 2025? Rates are reviewed on a quarterly basis.

Know More about Mileage Reimbursement 2025 Rates ITILITE, Passenger payments — cars and vans. 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own.

IRS Mileage Reimbursement Rate 2025 Know Rules, Amount & Eligibility, April 1, 2025 the kilometric rates (payable in cents per kilometre) below are payable in canadian funds only. The average car mileage reimbursement provided to all levels of employees was rm0.64 per km while the average motorcycle mileage reimbursement was rm0.35.

Mileage Reimbursement 2025 Uk 2025 Elyse Imogene, Irs mileage reimbursement rates for 2025. Every year the commissioner of the inland revenue sets the motor vehicle kilometre expense rates for businesses.

Mileage Reimbursement 2025 Uk Calculator Meggy Silvana, 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

The average car mileage reimbursement provided to all levels of employees was rm0.64 per km while the average motorcycle mileage reimbursement was rm0.35.

For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.