When Is Bas Due 2025. Rbi's mpc meeting in april 2025 likely to maintain repo rate at 6.5% due to inflation concerns. If you work with a registered tax agent like h&r block you are automatically given an extension on your.

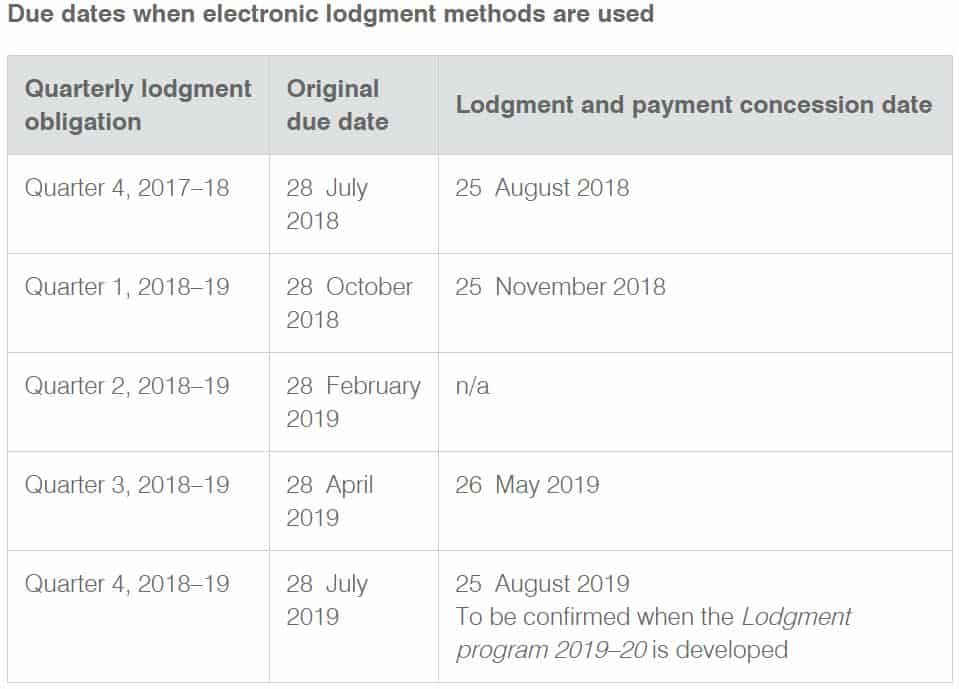

For quarterly gst reporting, deadlines typically fall on 28 october, 28 february, 28 april, and 28 july. Backgroundbiogenic amines (bas) in high concentrations are toxic and may cause a series of health symptoms.

Make BAS Preparation Easier with These TimeSaving Tips Work, If you are on a monthly cycle your bas due. Quarter 2 (1 october 2025 to 31 december 2025):

BAS Due Dates [2025 2025] All The Info You Need In 1 Place, Complete and return by the due date. These are the monthly bas due dates for 2025 / 2025:

![BAS Due Dates [2025 2025] All The Info You Need In 1 Place](https://creditte.com.au/wp-content/uploads/2022/02/BAS-due-dates.jpg)

When Is BAS Due in 20232024? Everything You Need to Know, Bas due date october 2025: 1 oct to 31 dec.

Bas Statement Due Dates AtoTaxRates.info, Due dates | australian taxation office. Your business must lodge a tax return each year, and you may need to lodge business.

BAS Due Dates Guide 2025 for Business Owners TMS Financial, Bas due date july 2025: A sensitive measurement of ba levels is essential for human.

What is BAS Due Dates [2025 2025] and How to Lodge it My Tax Daily, Complete and return by the due date. Whether you lodge monthly, quarterly, or annually, our guide.

![What is BAS Due Dates [2025 2025] and How to Lodge it My Tax Daily](https://mytaxdaily.com.au/wp-content/uploads/2023/10/bas-due-date-image-02-1024x1024.webp)

Key BAS due dates for your calendar QuickBooks, Lodge by the 28 october. Lodge by the 28 february.

BAS Lodgement Due Dates for Australian Small Businesses (2025, Due date for the deposit of tax deducted/collected by an office of the government for march 2025. A business activity statement (bas) is a form which a business submits to the australian taxation office.

Bah And Bas Rates Military Tribunal Information, If you are not required to file a tax return, the annual. How to lodge your business activity statements (bas) to report and pay your taxes, including gst and payg.

Due Dates for BAS Jaha Online Accountant, For quarterly gst reporting, deadlines typically fall on 28 october, 28 february, 28 april, and 28 july. What if you miss it?